GREENWICH, Conn.--(BUSINESS WIRE)--TICC Capital Corp. (NASDAQ:TICC) (the "Company," "TICC," "we," or "our") today sent a letter to stockholders regarding the Company’s Special Meeting urging them to support the previously announced agreement under which an affiliate of Benefit Street Partners, LLC (“BSP”) would become the Company’s new investment adviser. The letter and additional information regarding TICC’s Special Meeting can be found at www.TICCBSPAgreement.com.

The full text of the letter is as follows:

October 13, 2015

Please sign & return the enclosed white proxy card today!

Dear Fellow TICC Capital Corp. Stockholder:

TICC’s Special Meeting on October 27th is rapidly approaching-- your vote is crucial to protect your investment in TICC Capital Corp. and your quarterly distribution. WE URGE YOU TO VOTE THE ENCLOSED WHITE PROXY CARD TODAY.

THE FACTS ABOUT YOUR DISTRIBUTION

TPG BDC MISREPRESENTATION ONE: Over the last few weeks, TPG Specialty Lending, Inc. (“TPG BDC”) has suggested that TICC’s distributions are improperly inflated. This is FALSE – TPG BDC is attempting to mislead you and we want to set the record straight.

We would like to provide you with some facts about TICC’s distributions. TICC is currently paying distributions consistent with what is required by the Internal Revenue Service (“IRS”) for regulated investment companies. Under IRS rules we MUST PAY OUT A MINIMUM 90% of our TAXABLE INCOME to maintain our favorable tax status, and 98% of TAXABLE INCOME to avoid a 4% excise tax on the undistributed portion above 90%.

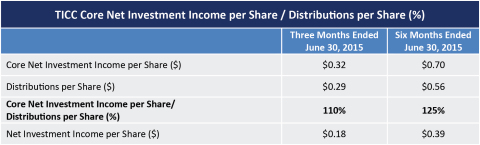

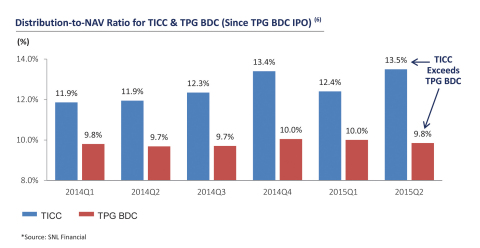

As we have discussed previously, TICC’s GAAP income has recently been lower than its core net investment income due to differences between tax and GAAP accounting policies for CLO investments. Our experience is that our cash flows have historically represented a reasonable estimate of our total taxable earnings and, as such, are included in our measurement of “core” net investment income (which we use as a proxy for estimating our taxable income prior to finalizing our tax return). TICC’s core net investment income in the first half of 2015 has exceeded our distributions for that period.1 Ultimately, this complication is part of the reason the CLO asset class is not a great fit for BDCs and reducing TICC’s CLO exposure is part of BSP’s transition plan. To summarize, TPG BDC’s statements about TICC’s distributions are either PURPOSEFULLY MISLEADING, OR they are unfamiliar with the impact on our taxable income of our CLO equity investments.

See accompanying Graphic 1.

TPG BDC MISREPRESENTATION TWO: TPG BDC has also claimed that we are making promises about future distributions. That is FALSE as well – this is just another example of TPG BDC trying to mislead you. As everyone knows, no one can or would guarantee long-term distributions and to suggest that we were doing so is disingenuous.

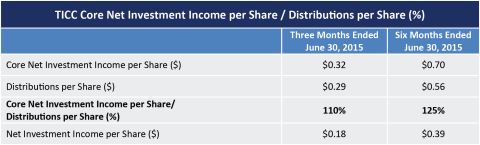

What we do know, and what we have been saying clearly, is that under the BSP investment advisory agreement, TICC stockholders would experience NO immediate reduction to current distributions while under the TPG BDC proposal TICC stockholders are expected to experience an IMMEDIATE 42% reduction in current distributions.2 This is basic math and a fact that TPG BDC is unable to deny so it tries to obfuscate.

Based on TPG BDC’s proposal, your annual per share distributions would decrease from $1.16 to $0.673. That is an immediate loss of almost half!

See accompanying Graphic 2.

Going forward, while we can’t predict long-term distributions and never would, we would expect near-term distributions to be superior to distributions under the TPG BDC proposal based simply on the expected pro forma profile of our portfolio, and the lower fees that are guaranteed with the BSP investment advisory agreement.

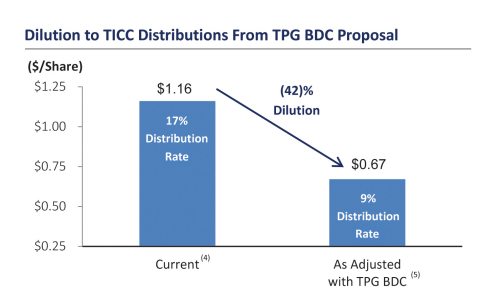

It is a simple fact that TPG BDC’s distribution rate has never come close to TICC’s.5 TICC’s distribution-to-NAV ratio of 13.5% is 37% higher than TPG BDC’s ratio of 9.8%. In fact, since going public TPG BDC has never had a distribution-to-NAV ratio that exceeded 10%. TPG BDC’s expensive fee structure helps explain part of this result.

See accompanying Graphic 3.

What Does All Of This Mean For TICC Stockholders?

It means you should vote the WHITE proxy card today. The BSP investment advisory agreement remains the most attractive offer for stockholders and importantly, is the only agreement TICC stockholders can vote for on October 27th. A “no” vote for the BSP investment advisory agreement will result in no changes to TICC’s current investment advisory agreement or Board of Directors.

EVERY VOTE COUNTS!

WE URGE YOU TO VOTE THE WHITE CARD TODAY!

Thank you for your support.

Sincerely,

Steve Novak

Chair, Special Committee, TICC Capital Corp.

Important

Your Vote Is Important. No matter how many shares of TICC’s common stock you own, please vote your WHITE proxy today, to ensure that your instructions are received in a timely manner. We urge you to vote by telephone or Internet by following the instructions on the enclosed WHITE proxy card or by signing, dating and mailing your card in the enclosed envelope.

If any of your shares of common stock are held in the name of a brokerage firm, bank, bank nominee or other institution, they can only vote your shares upon receipt of your specific instructions.

If you have any questions or require any additional information concerning the TICC Capital Corp. Special Meeting, please contact our proxy solicitor, Okapi Partners at:

|

OKAPI PARTNERS

|

Okapi Partners LLC |

1 A portion of TICC's 2015 distributions may include a return of capital for tax purposes. Additional information on TICC’s calculation of core net investment income (which is a non-GAAP measure) can be found in Exhibit A to this letter

2 In comparison to, or as would be the case under, the TPG BDC proposal. Under the TPG BDC proposal, the per share distribution would decrease by ~42% from $1.16 to $0.67 based on the exchange ratio (of 0.43x, TPG BDC stock price close on 9/15/2015) adjusted equivalent share price to TICC shareholders on a pro forma basis

3 Under the TPG BDC proposal, the per share distribution would decrease by ~42% from $1.16 to $0.67 based on the exchange ratio (of 0.43x, TPG BDC stock price close on 9/15/2015) adjusted equivalent share price to TICC shareholders on a pro forma basis

4 As of 6/30/2015, per Company filings

5 Represents the exchange ratio (of 0.43x, TPG BDC stock price close on 9/15/2015) adjusted equivalent share price to TICC shareholders on a pro forma basis; assumes transaction expenses of 2.5% of assets

6 Financial information as of 6/30/2015

Exhibit A

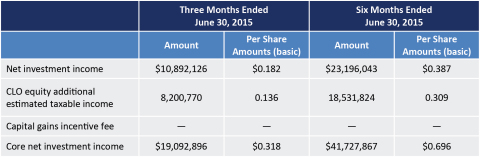

On a supplemental basis, we provide information relating to core net investment income and its ratio to net assets, which are non-GAAP measures. These measures are provided in addition to, but not as a substitute for, net investment income. Our non-GAAP measures may differ from similar measures by other companies, even if similar terms are used to identify such measures. It should be noted that the current description of core net investment income differs from prior descriptions due to the change in the method of accounting for CLO equity investment income, effective January 1, 2015. Core net investment income represents net investment income adjusted for additional taxable income on our CLO equity investments and also excludes our capital gains incentive fee.

Income from CLO equity investments, for generally accepted accounting purposes, is recorded using the effective yield method. This method requires the calculation of an effective yield to the expected redemption based on a projection of future cash flows. The differential between the actual cash distributions recorded and the effective yield income is applied as an adjustment to cost. The effective yield is reviewed quarterly and adjusted as appropriate. Accordingly, investment income recognized on CLO equity investments in the GAAP statement of operations differs from the estimated taxable net investment income (which is generally based upon the cash distributions actually received and record date distributions to be received by us during the period), and the resulting difference is referred to below as “CLO equity additional estimated taxable income.” In addition, since the capital gains incentive fee, for generally accepted accounting purposes, is based on the hypothetical liquidation of the entire portfolio (and as any capital gains incentive fee may be non-recurring), such fees are excluded when calculating core net investment income. We believe that core net investment income is a useful indicator of performance during this period. Further, because the RIC requirements are to distribute taxable earnings, and capital gains incentive fees may not be fully currently tax deductible, core net investment income provides a better indication of estimated taxable income for the period.

Accompanying Graphic 4 provides a reconciliation of net investment income to core net investment income (for the three and six months ended June 30, 2015).

About TICC Capital Corp.

TICC Capital Corp. is a publicly-traded business development company principally engaged in providing capital to established businesses, investing in syndicated bank loans and purchasing debt and equity tranches of collateralized loan obligations.

Additional Information and Where to Find It

In connection with the approval of the proposed new investment advisory agreement, the Company has filed relevant materials with the SEC, including a definitive proxy statement on Schedule 14A. The Company has distributed the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the approval of the proposed new investment advisory agreement. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE APPROVAL OF THE PROPOSED NEW INVESTMENT ADVISORY AGREEMENT THAT THE COMPANY FILES WITH THE SEC, BECAUSE THESE MATERIALS CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE APPROVAL OF THE PROPOSED NEW INVESTMENT ADVISORY AGREEMENT. The definitive proxy statement and other relevant materials in connection with the approval of the proposed new investment advisory agreement, and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC's website (http://www.sec.gov), at the Company's website (http://www.ticc.com), or by writing to the Company at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830 (telephone number 203-983-5275).

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company's stockholders with respect to the approval of the proposed new investment advisory agreement. Information about the Company's directors and executive officers and their ownership of the Company's common stock is set forth in the proxy statement on Schedule 14A filed with the SEC on September 3, 2015, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2014. Information regarding the identity of the potential participants, and their direct or indirect interests in the approval of the proposed new investment advisory agreement, by security holdings or otherwise, are set forth in the proxy statement and other materials filed or to be filed with SEC in connection therewith.

Forward Looking Statements

This press release contains forward-looking statements subject to the inherent uncertainties in predicting future results and conditions. Any statements that are not statements of historical fact (including statements containing the words "believes," "plans," "anticipates," "expects," "estimates" and similar expressions) should also be considered to be forward-looking statements. Certain factors could cause actual results and conditions to differ materially from those projected in these forward-looking statements. These factors are identified from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update such statements to reflect subsequent events.