PRINCETON, N.J.--(BUSINESS WIRE)--The absence of very severe catastrophes and a quiet hurricane season in the North Atlantic meant that losses from natural catastrophes in 2014 were much lower. In North America, overall losses of US$ 30bn and insured losses of US$ 18bn were well below the average values for the last ten years (US$ 77bn and US$ 38bn). At US$ 7bn, the most expensive event globally in terms of overall loss was Cyclone Hudhud in India.

The greatest losses in North America over the past year stemmed from the unusually cold winter. Heavy frost lasting for weeks in many parts of the US and Canada, along with heavy snowfalls and blizzards, particularly on the East Coast of the US, caused winter storm losses of US$ 3.7bn in 2014 alone, of which US$ 2.3bn was insured.

“The large winter losses again illustrate the importance of improving the susceptibility of infrastructure in the US, which can lead to significant reductions in loss amounts for many weather events. More importantly, these investments can save lives, and enable communities to more quickly recover from the severe fiscal and emotional impact of natural catastrophes,” said Tony Kuczinski, President and CEO of Munich Reinsurance America, Inc. “We believe that public-private partnerships are necessary to address the scope of infrastructure challenges and solutions. One good example of this effort is our industry’s collaboration through the Insurance Institute for Business & Home Safety (IBHS), which conducts scientific research at its South Carolina Research Center to identify and promote effective actions that strengthen homes, businesses and communities against natural disasters and other causes of loss.”

In Brazil, the absence of rain since December 2013 has seriously affected the agricultural sector. Particularly hard hit were coffee and sugar cane plantations. The São Paulo region suffered a water shortage, and the overall loss is estimated at US$ 5bn.

Direct losses in California remained within reasonable limits, despite a drought there that was the worst since precipitation and temperature record keeping began in 1895.

The global analysis of natural catastrophe statistics for 2014 reflected a lower number of fatalities: around 7,700 people lost their lives in natural catastrophes, a figure roughly comparable to that of 1984.

“Though tragic in each individual case, the fact that fewer people were killed in natural catastrophes last year is good news. And this development is not a mere coincidence. In many places, early warning systems functioned better, and the authorities consistently brought people to safety in the face of approaching weather catastrophes, for example before Cyclone Hudhud struck India’s east coast and Typhoon Hagupit hit the coast of the Philippines,” said Munich Re Board member Torsten Jeworrek. “However, the lower losses in 2014 should not give us a false sense of security, because the risk situation overall has not changed. There is no reason to expect a similarly moderate course in 2015. It is, however, impossible to predict what will happen in any individual year.”

The year at a glance

- Overall losses from natural catastrophes totaled US$ 110bn (previous year US$ 140bn), of which roughly US$ 31bn (previous year US$ 39bn) was insured.

- The loss amounts were well below the inflation-adjusted average values of the past ten years (overall losses: US$ 190bn, insured losses: US$ 58bn), and also below the average values of the past 30 years (US$ 130bn/US$ 33bn).

- At 7,700, the number of fatalities was much lower than in 2013 (21,000) and also well below the average figures of the past ten and 30 years (97,000 and 56,000 respectively). The most severe natural catastrophe in these terms was the flooding in India and Pakistan in September, which caused 665 deaths.

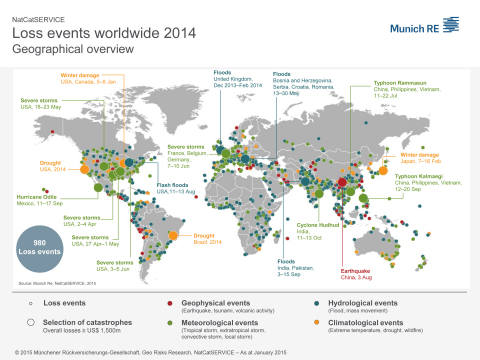

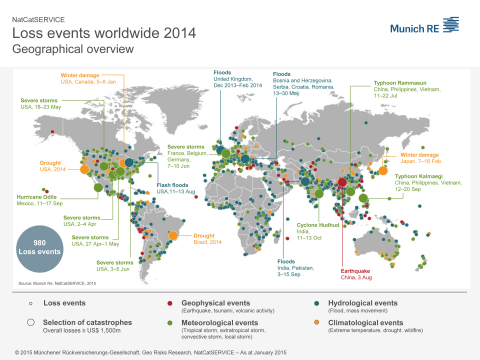

- In total, 980 loss-related natural catastrophes were registered, a much higher number than the average of the last ten and 30 years (830 and 640). Broader documentation is likely to play an important role in this context, since, particularly in years with low losses, small events receive greater attention than was usual in the past.

- The costliest natural catastrophe of the year was Cyclone Hudhud, with an overall loss of US$ 7bn. The costliest natural catastrophe for the insurance industry was a winter storm with heavy snowfalls in Japan, which caused insured losses of US$ 3.1bn.

More than nine out of ten (92%) of the loss-related natural catastrophes were due to weather events. A striking feature was the unusually quiet hurricane season in the North Atlantic, where only eight strong – and thus named – storms formed; the long-term average (1950–2013) is around 11. In contrast, the tropical cyclone season in the eastern Pacific was characterized by an exceptionally large number of storms, most of which did not make landfall. One storm in the eastern Pacific, Hurricane Odile, moved across the Baja California peninsula in a northerly direction and caused a loss of US$ 2.5bn (of which US$ 1.2bn was insured) in Mexico and southern states in the US. In the northwestern Pacific, a relatively large number of typhoons hit the Japanese coast, but losses there remained small thanks to the high building and infrastructure standards in place.

“The patterns observed are well in line with what can be expected in an emerging El Niño phase. This characteristic of the ENSO (El Niño Southern Oscillation) phenomenon in the Pacific influences various weather extremes throughout the world,” explained Peter Höppe, Head of Geo Risks Research at Munich Re. Water temperatures in the North Atlantic were below average. Atmospheric conditions such as lower humidity and stronger wind shear also inhibited the development of tropical cyclones. Even events like the severe windstorms and heavy rainfall in California in December following a long drought fit in with the El Niño pattern.

Höppe added that most scientists expect a light to moderate El Niño phase to persist until mid-2015. “Following the below-average incidence in 2014, this could increase the frequency of tornadoes in the USA. If the El Niño phase does, in fact, end towards the middle of the year, there would be no cushioning affects from the ENSO oscillation in the main phase of the tropical storm season.”

The costliest natural catastrophe of the year, Cyclone Hudhud, also illustrated the practical effect of measures by the authorities to limit damage. Hudhud reached its maximum strength on 10 October over the Gulf of Bengal, and with wind speeds of over 190 km/h, was a Category 4 storm (of a maximum 5). On 12 October, it made landfall near the Indian port of Visakhapatnam, an important economic centre with a population of two million in the Andhra Pradesh region. In some places, more than 120 litres of rain per square metre fell within 24 hours. Thanks to warnings from the Indian weather service, the authorities evacuated around half a million people and brought them to secure accommodation. This kept the number of fatalities for a catastrophe of this strength at a low level (84). Of the overall losses of approximately US$ 7bn, roughly US$ 530m was insured – a comparatively small proportion, but insurance density in India is showing pleasing constant growth.

On 24 August, an earthquake in the Napa Valley in California close to the town of Napa was like a wake-up call. Napa lies within a highly exposed, 70 km-wide zone that has several known faults forming part of the greater San Andreas fault system. Here the Pacific plate in the west is sliding past the North American plate in the east at the rate of roughly 6 cm per year. The earthquake had a magnitude of 6.0 and was therefore not extraordinarily strong for this region. Nevertheless, a large number of buildings were badly damaged. The economic loss amounted to US$ 700m, of which US$ 150m was insured. In many businesses in the important winegrowing area of this region, wine-processing machines were damaged and stocks destroyed. “The earthquake shows that the San Francisco region must prepare itself for bigger tremors too. However, these cannot be predicted,” said Höppe.

Note:

Graphics and a world map with all the events are available on

our website for download:

Link

Munich Reinsurance America, Inc. and the Insurance Information Institute will host a webinar for US and international journalists today to explain the global figures and give details about US events. The webinar will take place at 10.00 a.m. (4.00 p.m. CET). Journalists can register under: Link

Note for editorial departments

For further information, please

contact:

Media Relations Munich, Michael Able

Tel.: +49 (89) 3891-2934

Media Relations Asia, Lilian Ng

Tel.: +852 2536 6939

Media Relations North America:

Beate Monastiridis-Dörr

Tel.:

+1 (609) 235-8699

Sharon Cooper

Tel.: +1 (609) 243-8821

Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the 2013 business year the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €3.3bn on premium income of over €51bn. It operates in all lines of insurance, with almost 45,000 employees throughout the world. With premium income of around €28bn from reinsurance alone, it is one of the world's leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in the ERGO Insurance Group, one of the major insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2013, ERGO posted premium income of €18bn. In international healthcare business, Munich Re pools its insurance and reinsurance operations, as well as related services, under the Munich Health brand. Munich Re's global investments amounting to €209bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.

Disclaimer

This press release contains forward-looking statements that are based on current assumptions and forecasts of the management of Munich Re. Known and unknown risks, uncertainties and other factors could lead to material differences between the forward-looking statements given here and the actual development, in particular the results, financial situation and performance of our Company. The Company assumes no liability to update these forward-looking statements or to conform them to future events or developments.

Princeton, NJ January 7, 2015

Munich Reinsurance America, Inc.

555

College Road East

Princeton, NJ 08553-0421

United States