NEW YORK--(BUSINESS WIRE)--Retailers facing intense competition to win and maintain new customers can gain an advantage by leveraging partnerships with payments providers, according to new research released today by COLLOQUY.

The report, sponsored by Chase Merchant Services and titled, Ally in Aisles and Online, is available as a free download on COLLOQUY.com and features polling data from both retail representatives and consumers. It reveals the biggest challenges facing retailers seeking to provide a seamless and secure experience to customers. This includes giving customers relevant offers, delivering value without increasing funding rates and converting sales through the checkout process.

“Retailers have to adapt to succeed and payments providers are ideal partners,” said Mike Passilla, CEO of Chase Merchant Services, the global payment processing, merchant acquiring and offers business of JPMorgan Chase & Co. “Banks and payments providers are at the forefront of innovation and can help merchants optimize the shopping experience for customers, such as implementing mobile technologies, ensuring secure payments and offering marketing insights.”

Key findings from Ally in the Aisles and Online, an analysis examining what consumers demand and what retailers need to provide, include:

- Sixty percent of retailers admitted they lack reliable data to support effective targeting of new customers for acquisition purposes.

- Eighty five percent of merchants are in search of ways to add value to their retail offering outside of discounts, promotions and /or loyalty programs.

- Seventy six percent of merchants believe a strategic partnership would provide opportunities to enhance their value proposition to customers, however, only 31 percent reported partnering with a payments provider.

“Businesses need tools and resources beyond what they alone can provide,” said Jeff Berry, research director for COLLOQUY. “The pressure on retailers to gain customers by offering an experience that is attractive yet doesn’t break their budgets is high, and what many businesses do not realize is that payment providers can be part of the solution.”

Providing Customers With Relevant Offers

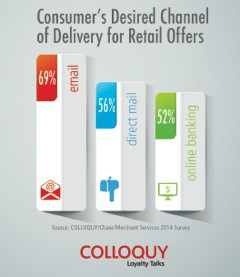

Many retailers fail to reach customers because they have access to limited data that doesn’t paint a full picture. While 50 percent of merchants reported using spend data outside of their own retail locations, 79 percent agreed that understanding how customers spend outside their locations/properties would be a tremendous marketing tool. The benefits of having that type of data are clear: Of the 31 percent of retailers that partner with banks or credit card issuers, 88 percent send offers to existing customers and 76 percent send offers to new customers.

Delivering More Value While Controlling Costs

Sixty-one percent of retailers reported using points or benefits through the company’s loyalty program as a means of adding value to the customer relationship. However, 83 percent said that giving their loyalty members more reward options is important and want to ensure members spend rewards at their stores rather than redeem elsewhere.

The data again found partnering with payments providers underutilized by retailers. Only 48 percent partner with other brands to deliver discount offers to their customers, yet 76 percent agree that strategic partnerships with complementary brands would provide them with more opportunities to enhance their respective value propositions without significant extra cost.

Offering Seamless Checkout Experiences Across All Channels

Getting a customer to a store or website is the first step, but ensuring the visit results in a sale is just as important. Eighty-six percent of retailers believe a poor checkout experience, either online or in-store, can be a competitive disadvantage, especially versus their strongest competitors.

With security becoming an increasingly important factor and new technologies enabling mobile payments gaining popularity, payments providers are ideal partners capable of providing solutions to retailers that meet customers’ expectations.

About the Survey

Two online surveys were performed in October 2014: a retailer survey and a customer survey. The retailer survey was conducted among 234 middle-and-upper-management corporate employees from U.S. retailers with annual revenue of $20 million and above, while the customer survey was conducted among a sample of 1,001 respondents that are nationally representative of the U.S. population.

About Chase Merchant Services

Chase Merchant Services is the global payment processing, merchant acquiring and offers business of JPMorgan Chase & Co. and a leading provider of payment, fraud and data security, capable of authorizing transactions in more than 130 currencies. The company’s proprietary platforms enable integrated solutions for all payment types, including credit, debit, prepaid stored value and electronic check processing; as well as alternative and mobile payment options. Chase Merchant Services has combined proven payment technology with a long legacy of merchant advocacy that creates quantifiable value for companies large and small. In 2013, Chase Merchant Services processed 35.6 billion transactions with a value of $750.1 billion. More information can be found at www.chasepaymentech.com.

About COLLOQUY

COLLOQUY® is a publishing, education and research practice that brings together loyalty practitioners from around the world. The go-to resource for loyalty intelligence since 1990, COLLOQUY engages and educates loyalty marketers with its magazine, weekly e-newsletter, and timely and comprehensive loyalty-marketing website, colloquy.com. In each issue of the magazine, the “COLLOQUY Recognizes” feature highlights excellence in loyalty. COLLOQUY delivers industry-leading loyalty benchmarking reports and educational workshops, webinars and speeches. The COLLOQUY Summit is the premiere annual loyalty event. Advertising, sponsorship and publishing opportunities are available via the COLLOQUY Network, a global partnership of loyalty service providers. COLLOQUY is an independently operated division of LoyaltyOne. To learn more, visit colloquy.com.