CAMBRIDGE, Mass.--(BUSINESS WIRE)--Though the Dow increased nearly 2,000 points from September 2012 to the same period in 2013, investors’ willingness to take on more risk exposure remains virtually unchanged. Furthermore, this stubborn holding pattern is consistent across all age and wealth segments. This and other findings are included in the recently released 7th annual Investor Brandscape®, a Cogent Reports™ study from Market Strategies International.

Overall, investors indicate that they distribute 36% of their assets into “low risk” investments, 44% into “moderate risk,” and the remaining 20% of assets into “high risk” investments. This risk distribution is identical to that which was reported a year earlier in September of 2012. While risk profiles vary by age, over the one-year period no discernible changes in risk tolerance took place within any of the five generational cohorts examined in the study: Generations X and Y, 1st and 2nd Wave Boomer, and Silent Generation investors.

“To use a timely analogy, it’s as if a Polar Vortex has descended upon investors,” says Meredith Lloyd Rice, senior product director and lead author of the report. “There is little evidence that investors are chasing returns and increasing risk the way they have in past market rallies. In fact, investors this year report that they have an even greater proportion of their assets in cash than they did in 2012.”

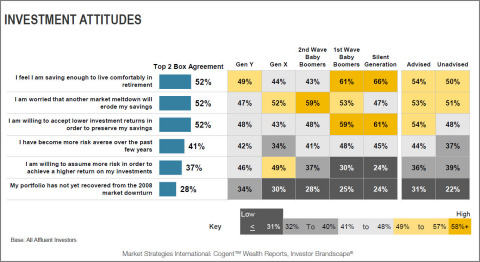

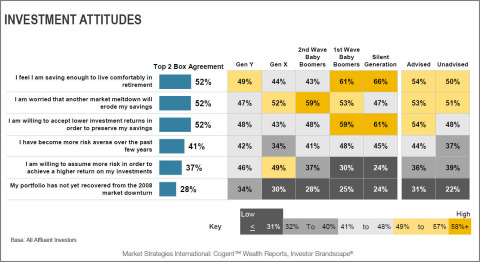

A number of factors help explain investors’ current mind-set. According to the report, 52% say they are willing to accept lower investment returns in order to preserve their savings, and an equal proportion, 52%, are worried about another market meltdown eroding their savings. “These broad sentiments are felt by investors, regardless of age,” say Lloyd Rice. “For many older investors, their risk-taking days are over. For many younger investors, they have yet to begin.”

About Investor Brandscape

Cogent Reports interviewed a sample of 4,170 affluent investors that were recruited from the Research Now opt-in online panel. Respondents were required to have at least $100,000 in investable assets (excluding real estate). Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies will supply the exact wording of any survey question upon request.

About Market Strategies International

Market Strategies International is a market research consultancy with deep expertise in communications, consumer/retail, energy, financial services, healthcare and technology. The firm is ISO 20252 certified, reflecting its commitment to providing intelligent research, designed to the highest levels of accuracy, with meaningful results that help companies make confident business decisions.

Market Strategies conducts qualitative and quantitative research in 75 countries, and its specialties include brand, communications, customer experience, product development, segmentation and syndicated. Its syndicated products, known as Cogent Reports, help clients understand the market environment, explore industry trends and evaluate and monitor their brand and products within the competitive landscape. Founded in 1989, Market Strategies is one of the largest market research firms in the world, with offices in the US, Canada and China. Read Market Strategies’ blog at FreshMR, and follow us on Facebook, Twitter and LinkedIn.