CHICAGO--(BUSINESS WIRE)--While the industry braces for open enrollment – and the additional 11 to 13 million Americans expected to be seeking insurance this year – new research by Valence Health shows that traditional commercial health plans might soon face increasing competition from alternative payers. The study, “U.S. Attitudes Toward Health Insurance and Healthcare Reform,” revealed that more than a third of Americans are open to trying insurance plans offered through hospitals, health systems or state-run Consumer Oriented and Operated Plans (CO-OPs).

The survey of more than 550 respondents, ages 18 to 60+, included men and women with varying household incomes (ranging from under $25,000 to over $150,000) and political views (Democrats, Republicans, Independents and others). Designed to gauge perceptions of the commercially insured, the survey also included some input from those covered by other payers, including Medicare and Medicaid.

“We may be about to see a major shift in the way Americans choose to buy health insurance,” said Kevin Weinstein, Valence Health Chief Marketing Officer. “If only five percent of insured Americans actually try new insurance options, that translates to nearly 10 million people who account for more than $20 billion in healthcare spending. Imagine if we start to educate the majority of people who said they were still unsure about their options. We are talking about creating a huge monetary shift in the industry.”

Key Survey Findings

New Insurance Options

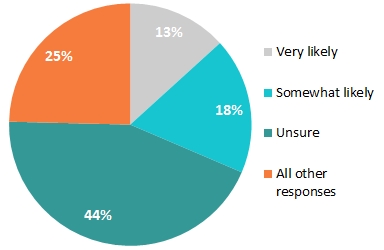

- More than 31% of respondents said they were very or somewhat likely to purchase health insurance through their local hospital or health system.

- 23% said hospital-sponsored plans would be less expensive, and higher quality than traditional insurance plans, and 39% said provider-sponsored health plans would offer more coordinated care (see Chart 1: Provider-sponsored plans).

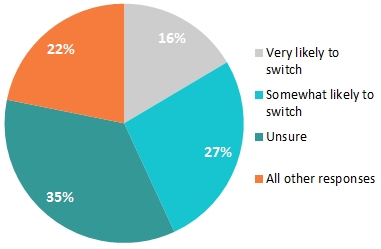

- More than 43% said they were very likely or somewhat likely to consider switching to the CO-OPs (see Chart 2: CO-OPs).

Choosing Health Insurance

- More than 39% said they were very unlikely to use online insurance exchanges; majority prefer insurance through employers.

- Less than 10% said they are willing to accept salary increase or stipends to purchase out of pocket health insurance.

Perception of “Obamacare”

- While a majority of respondents were for “Obamacare,” a majority also thought that insurance rates would rise due to health reform.

Prioritizing Cost and Coverage

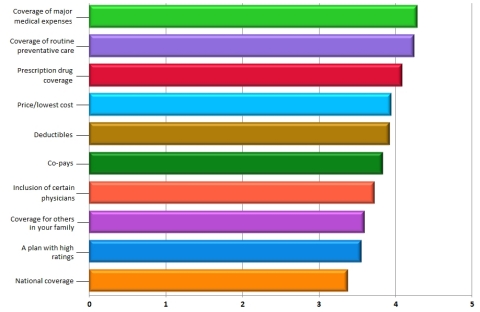

According to the report, most of Americans’ health insurance choices are driven by plan benefits and price, as opposed to physician choice (see Chart 3 Top 10 Priorities). Coverage of emergency room visits and hospital stays were the top priorities, while the insurance company’s “brand name” held the least importance.

“What’s interesting is that we may be shifting away from the era where big brand, commercial insurance companies take the largest piece of the pie,” said Weinstein. “Consumers are open and ready to try smaller, local systems, not only because it’s potentially easier on the wallet, but also because they perceive it to be more convenient and may lead to better overall patient healthcare outcomes.”

Need for Education

When asked specific questions about their options under healthcare reform, or Obamacare, a majority of the respondents said they “don’t know” or were “unsure,” revealing not only that Americans are open to learning, but need more education about their options.

“Consumers are playing a greater role in their own healthcare, which is a trend that will only grow in the future,” said Weinstein. “Americans want more options for healthcare and we have an opportunity to empower them with the information they need to make financially prudent choices that meet their personal healthcare requirements.”

The complete research findings are available at http://valencehealth.com/resources/white-papers.

About Valence Health:

Valence Health provides healthcare organization solutions for value-based care, helping them better manage their patient populations and accept financial responsibility for the quality of the care they provide. With unique data collection and analysis solutions, Valence Health has emerged as a leader in population management and clinical integration, serving dozens of clients from physician groups to standalone hospitals to large IDNs such as Cleveland Clinic. In-depth actuarial analysis combined with operational excellence allows Valence to not only advise but also provide ongoing services to provider organizations operating under various value-based reimbursement models. From risk-based contracting to accountable care organizations (ACOs) to administering provider-sponsored health plans, Valence has been helping providers appropriately accept and manage financial responsibility while improving clinical quality since 1996. Headquartered in Chicago, with three other office locations, Valence Health serves more than 30,000 physicians and 100 hospitals, helping them manage the health of 15 million patients nationwide. Follow Valence Health on LinkedIn and Twitter.