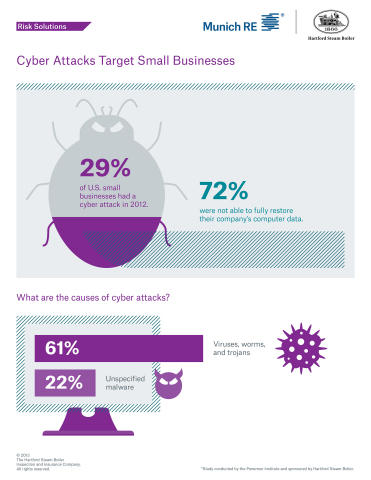

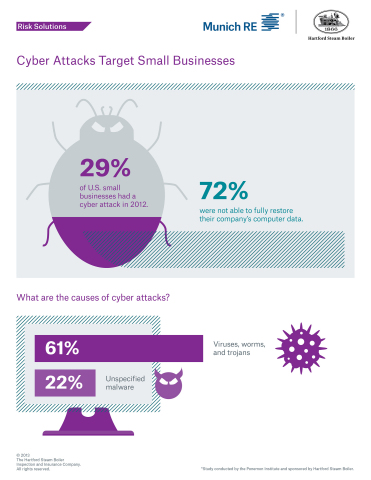

HARTFORD, Conn.--(BUSINESS WIRE)--Almost one-third of U.S. small businesses surveyed by the Ponemon Institute had a cyber attack in the previous year, it was reported today in a study sponsored by The Hartford Steam Boiler Inspection and Insurance Company (HSB), part of Munich Re, and nearly three-quarters of those businesses were not able to fully restore their company’s computer data.

“The Internet connects even the smallest businesses to data networks and computer systems around the world,” said Timothy Zeilman, vice president for Hartford Steam Boiler. “This access also exposes companies to hackers, viruses and other computer attacks that can corrupt critical data, shut down their operations and make them liable for compromised information.”

The primary causes of cyber attacks on small businesses were computer viruses, worms and Trojans (61 percent) and unspecified malware (22 percent), the Ponemon Institute reported. Following the cyber attacks, 72 percent were not able to fully restore their company’s data.

The survey found that 29 percent of the small businesses experienced a computer-based attack. The consequences of those attacks included managing potential damage to their reputations (59 percent); theft of business information (49 percent); the loss of angry or worried customers (48 percent) and network and data center downtime (48 percent).

The report on cyber risks resulted from a two-part study conducted for Hartford Steam Boiler, which offers a suite of products and services to help smaller commercial organizations manage their information exposures. In recently released findings on data breaches, the Ponemon Institute surveyed the same small businesses, health care providers and professionals around the U.S. and found that 53 percent had experienced a data breach and 55 percent of those businesses had multiple breaches.

About HSB

Hartford Steam Boiler (HSB), a member of Munich Re’s Risk Solutions family since 2009, is a leading engineering and technical risk insurer providing equipment breakdown insurance products, other specialty coverages, and related inspection services and engineering consulting. Founded in 1866, HSB's difference is grounded in extensive technical knowledge with over 50 percent of its staff engineers, inspectors and technical personnel around the globe. We leverage our knowledge to anticipate future risks and develop a range of specialized solutions that enable our clients to build deeper and more profitable customer relationships. HSB holds A.M. Best Company’s highest financial rating, A++ (Superior). www.hsb.com.

About the Ponemon Institute

The Ponemon Institute is a leading research center dedicated to privacy, data protection and information security policy. Often cited for its annual consumer studies on privacy trust, the Ponemon Institute’s research quantifying the cost of a data breach helps organizations understand the business impact of lost or stolen data.

About Munich Re

In the U.S., Munich Re provides access to a full range of property and casualty reinsurance and specialty insurance products through Munich Reinsurance America, Inc., American Modern Insurance Group and Hartford Steam Boiler Group. Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the financial year 2012, the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €3.2bn on premium income of around €52bn. It operates in all lines of insurance, with around 45,000 employees throughout the world. With premium income of around €28bn from reinsurance alone, it is one of the world’s leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in the ERGO Insurance Group, one of the major insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2012, ERGO posted premium income of €19bn. In international healthcare business, Munich Re pools its insurance and reinsurance operations, as well as related services, under the Munich Health brand. Munich Re’s global investments amounting to €214bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.