SAN DIEGO, Calif.--(BUSINESS WIRE)--The California State Teachers’ Retirement System (“CalSTRS”) and Relational Investors LLC (“Relational”), collectively owners of 7.3% of the common shares of The Timken Company, (NYSE: TKR) (“Timken” or “the Company”), today stated that the investment community strongly supports the passage of CalSTRS’ proposal, Item No. 6, to unlock shareholder value at Timken through the separation of the Company’s Steel and Bearings businesses.

The CalSTRS proposal has received broad support from investors, analysts, and the two leading independent proxy advisory firms, ISS and Glass Lewis. By voting FOR the CalSTRS proposal, shareholders will be putting Timken’s family-influenced Board on notice that the Board must take immediate action to effectuate a spin-off of the Company’s Steel business, which would eliminate the long-standing “conglomerate” discount that is dramatically impairing shareholder value.

In this regard, CalSTRS and Relational have sent Timken shareholders the following letter urging shareholders to VOTE FOR the proposal:

VIA ELECTRONIC AND OVERNIGHT MAIL

May 1, 2013

Dear Timken Shareholder:

You have an opportunity at the May 7th Timken annual shareholder meeting, to tell the Board unequivocally to unlock significant shareholder value by separating the Company’s Steel and Bearings businesses. By VOTING FOR the CalSTRS shareholder proposal, Item No. 6 in Timken’s Proxy Statement (the “Proposal”), you put the Timken Board on notice that you expect it to take immediate action to effectuate a spin-off of the Company’s Steel business which would eliminate the long-standing “conglomerate” discount impairing the value of your investment.

We, CalSTRS, the largest educator-only pension fund in the world, and Relational Investors, a multi-billion dollar asset management firm, own a combined 7.3% of Timken’s outstanding common shares valued at approximately $400 million.

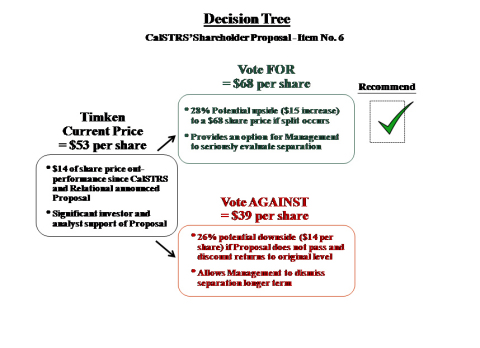

On November 28, 2012, the day we filed a joint 13D announcing the Proposal, Timken’s stock price increased 12% for a one-day return to Timken shareholders of approximately $450 million. Since then, Timken's stock price has gained 26%, with the potential, based on our analysis, for at least an additional 30% of value by splitting Timken’s stock. VOTING FOR the Proposal sends a clear message to the Board that shareholders do not want to forfeit this gain nor the additional value that can be realized over the long-term by having the Steel and Bearings businesses trade independently.

Since our initial filing, the investment community’s positive response, as reflected in the current stock price, has gained broad market support among fellow shareholders, some of who have expressly endorsed the merits of our analysis. As reported on Bloomberg, April 17, 2013:

“[The Steel business] creates a distraction.” “Investors are not putting an appropriate valuation on the core business.” “Relational and CalSTRS have made pretty convincing arguments.” (Timken shareholder Michael Willemse, Taylor Asset Management)

“When you look at the merits of the proposed spinout, we think it makes a lot of sense.” “We’d like to see it done.” (Timken shareholder Jason Detzi, Penn Capital Management)

By separating the Steel and Bearings businesses and allowing each to trade as independent companies, investors will be able to value Timken’s Bearings and Steel assets at a premium to the value under the current conglomerate structure. You have an opportunity to realize the full value of your investment in Timken by VOTING FOR the Proposal. Ask that the Board, which represents your interests, unlock significant value and end the Company’s unnecessary conglomerate structure that is causing the price discount at which your investment trades.

In addition to fellow shareholders and investment analysts, the two leading proxy advisory firms, Institutional Shareholder Services (“ISS”) and Glass Lewis & Co. (“Glass Lewis”), support the CalSTRS Proposal. Based on their own independent research and analysis, after hearing detailed presentations made directly by Timken and us, ISS and Glass Lewis recommend shareholders VOTE FOR our Proposal, Item No. 6 in the proxy statement.

In its report, ISS points to the investment community’s response as overwhelming evidence that the Steel and Bearings businesses will be optimally valued as independently traded entities. ISS writes:

“The market’s enthusiastic response to the proposal is surprising, given that the proposal itself is non-binding and, given that the board is unequivocal in its opposition to a spin-off, there would seem to be some uncertainty whether passage of the proposal would necessarily result in the board taking the prescribed action. The positive response, therefore, must be risk-adjusted for this possibility – and yet, given the strong outperformance of both the broader market and the peer group, appears not only a ringing endorsement of the credibility of the proponents – both well respected institutional investors – but also the great potential value other investors have been persuaded may be unlocked by the strategy.”

ISS further states that VOTING FOR the Proposal protects the value already created since the announcement:

“Given compelling evidence that the persistent valuation discount is due to the company's corporate structure, the strong and sustained market reaction to the proponent's non-binding proposal to redress that structural issue through a spin-off of the Steel business, the downside risk of rejecting a proposal which so many investors have literally already bought into, and the low risk of unintended consequences if it is approved, support FOR this proposal is warranted.”

Similarly, in its report, Glass Lewis highlights the compelling evidence we have presented and the value unlocking case we have made:

“In reviewing the fundamental positions presented by both the board and the Proponents, we generally find CalSTRS and Relational provide a more compelling quantitative case, backed by cogent and thoroughly explained analyses.”

“We find the board’s own quantitative analyses offer shareholders relatively poor insight, due, in part, to the application of what we consider to be questionable methodologies.”

“We are concerned the board is presenting shareholders with a skewed perspective on the stand-alone value of Timken’s BPT and steel businesses in order to diminish the perceived value of a split-up.”

“We find the Proponent provides a more realistic and verifiable estimate of the potential value available to Timken’s current shareholders through the spin-off.”

Glass Lewis concludes:

“The incumbent board has displayed, in our view, a clear and troubling track record of responsiveness to shareholder concern and, perhaps of greater note here, has strongly expressed its intention to pursue the status quo.”

Status quo means giving up the value already created in anticipation of a separation; therefore having your investment discounted again because the Timken family-dominated Board chooses to perpetuate a business structure that apparently only serves their interests. The Timken Board now veils its value-impairing conglomerate structure as an “integrated business model” while trying to convince shareholders that their strategy of an “ongoing transformation” is in their best interest. These core arguments and window-dressings are fallible:

- Timken boasts about its share performance to justify its conglomerate strategy, when in fact the Company’s stock price, during the CEO’s 11-year tenure and prior to the announcement of our proposal, has dramatically underperformed its closest bearings peer, SKF, and every major specialty steel peer, including Carpenter, Nucor, Steel Dynamics and Allegheny.

- Timken’s “synergies” argument is highly flawed and does not reflect the clear opportunity to mitigate dis-synergies, as Timken’s closest competitor, SKF, successfully did following the separation of its bearings and steel businesses. Indeed, the mid-point of Timken’s projected dis-synergies of $6-8 per share is no more than $2.65 per share higher than what we projected in our conservative analysis. That cost is insignificant compared to the stock appreciation to date and the potential upside from a split. Not to mention, Timken would be able to mitigate any incremental dis-synergy through normal and customary business relationships.

- Timken’s newest public response to the overwhelming number of parties – shareholders, investment analysts, ISS and Glass Lewis – that recommend ending the company's value-impairing conglomerate structure is, “they don't understand our business." Unfortunately, based on the Company's consistently underperforming stock price and the flawed arguments put forward by Timken to maintain the status quo, it is the Board choosing not to understand – even if it is at the expense of shareholder value and the long-term potential of the Company's businesses.

By VOTING FOR our Proposal, Item No. 6 in the proxy, shareholders create the free option not only to continue to benefit from the stock price appreciation reflecting the market’s anticipation of a separation, but also the option to realize the full value of their investment in Timken.

We thank you for your support.

Sincerely,

|

/s/ Anne E. Sheehan |

/s/ Ralph V. Whitworth |

||||||||

| Director of Corporate Governance | Principal | ||||||||

| California State Teachers’ Retirement System | Relational Investors LLC | ||||||||

P.S. You may receive a call directly from Timken's proxy solicitor asking you to vote your proxy over the telephone. If you get this call, please send the message to Timken that you want to enhance the value of your Timken investment by VOTING FOR Item No. 6 and ask Timken to send you a confirmation of your VOTE FOR our Proposal. If you have questions about how to vote your shares, please contact our information agent, Okapi Partners, at (877) 285-5990.

SHAREHOLDER PRESENTATION

Below is a link to the April 15, 2013 shareholder presentation: “Timken’s Flawed Analysis” http://www.sec.gov/Archives/edgar/data/98362/000110465913029112/a13-10050_2px14a6g.htm.

Below is a link to the March 21, 2013 shareholder presentation: “Why a

Separation of Timken’s Steel and Bearings Businesses Can Unlock

Significant Shareholder Value”:

http://unlocktimken.com/library/uploads/2013/03/ShldrPrsntnUpdate.pdf.

The presentation demonstrates the financial and operational logic of CalSTRS’ shareholder proxy proposal, which enables Timken shareholders to vote for separating the two businesses.

WHERE TO GET MORE INFORMATION

To learn more about the CalSTRS proposal and how to unlock significant shareholder value at Timken by allowing the market to independently value Timken’s Bearings and Steel businesses as pure-plays in their respective industries, please visit www.UnlockTimken.com.

About Relational Investors LLC:

Relational Investors LLC, founded in 1996, is a privately held, multi-billion dollar asset management firm and registered investment adviser. Relational invests in publicly traded companies that it believes are undervalued in the marketplace. The firm seeks to engage the management, board of directors, and shareholders of its portfolio companies in a productive dialogue designed to build a consensus for positive change to improve shareholder value.

About the California State Teachers Retirement System:

The California State Teachers’ Retirement System, with a portfolio valued at $163.7 billion as of March 31, is the largest educator-only pension fund in the world. CalSTRS administers a hybrid retirement system, consisting of traditional defined benefit, cash balance and voluntary defined contribution plans, as well as disability and survivor benefits. For 100 years, CalSTRS has served California's public school educators and their families, who now number 862,000 from the state’s 1,600 school districts, county offices of education and community college districts.