NEW YORK--(BUSINESS WIRE)--Hess Corporation (NYSE: HES) (“Hess” or “the Company”) today sent a letter to all shareholders in connection with its 2013 Annual Meeting of Shareholders, to be held on May 16, 2013.

The Board recommends that shareholders vote FOR the election of Hess’ highly qualified independent nominees on the WHITE proxy card.

For information about Hess’ transformation and the 2013 Annual Meeting, please visit: www.transforminghess.com.

Included below is the full text of the letter to Hess shareholders:

Dear Fellow Shareholder,

As you are aware, the hedge fund Elliott Management is seeking to install five of its nominees on the Hess board. They launched this divisive proxy contest without making any attempt to meet with Hess management, instead they are trying to mislead Hess shareholders by pursuing multiple attacks based on an array of distorted statistics.

Why does Elliott continue to push its aggressive campaign? We would like to pose a few questions for our shareholders.

Hess’ strategy is working. Why is Elliott trying to change it?

Elliott launched its campaign to effect a breakup plan that they have touted as the best strategy to “unlock” shareholder value. This flawed agenda has been roundly rejected by nearly every research analyst covering Hess, while the Hess transformation strategy has been widely applauded by those same analysts, with our stock outperforming our proxy peers on a total return basis by approximately 32% since January 1, 2013 (see research analyst commentary below). Further, based on recent conversations with shareholders, the superiority of Hess’ plan is beyond debate.

However, Elliott continues to pursue its flawed strategy, even though it has no experience running a large E&P company. This is a hedge fund that is well-known for its bare-knuckled approach and determined pursuit of its objectives, no matter how flawed. We caution Hess shareholders against putting the value of their investment at risk by supporting a hedge fund determined to replace Hess’ strategy with one that has been rejected.

Does Elliott really believe that its directors are independent?

In order to obtain nominees for its slate, Elliott was forced to be creative. It enticed its nominees by promising to separately pay them large bonuses based on short-term stock price appreciation, encouraging them to take excessive risks to achieve substantial payouts. In fact, these directors have already “earned” $750,000 each from Elliott under this pay scheme based solely on the success of Hess’ outstanding execution.

These nominees will be paid directly by Elliott while serving on the Hess Board, in amounts far greater than their compensation as Hess directors. Putting aside the basic corporate governance principles that this scheme violates (as discussed in the article “Are Shareholder Bonuses Incentives or Bribes” http://blogs.reuters.com/great-debate/2013/04/25/are-shareholder-bonuses-incentives-or-bribes/), these payments raise the questions: to whom will these directors answer to and where are their loyalties, to Elliott or Hess shareholders?

Why does Elliott continue to cherry-pick data to obscure Hess’ strong results?

Perhaps feeling the pressure of criticism from those who understand the E&P business, Elliott has tried to distract attention from their plan by using manipulated statistics to attack Hess’ performance, including ending most of their stock price charts to avoid capturing the price appreciation driven by the successful execution of our transformation strategy.

We recognize that, depending on the period you select and the companies you compare yourself to, we are not the top performer on every metric during every period. However, here are the “unadjusted” facts regarding our performance:

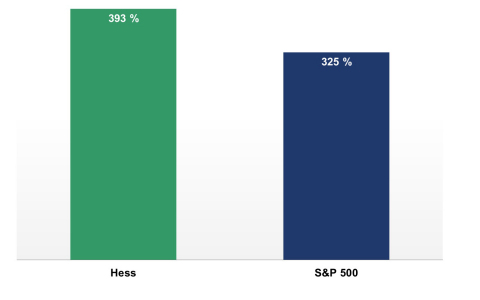

- Since 1995, Hess has returned nearly 400%, outperforming the S&P 500 by 68%

- Over the past decade, while Hess operated as an integrated company, it outperformed its integrated proxy peers by nearly 200%

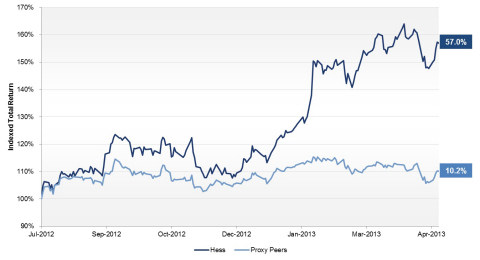

- Since July 25, 2012, when Hess provided the market with an update on its transformation to a pure play E&P, Hess stock has increased 57%, as compared to a 10% gain for our peer group

Why is Elliott trying to take credit for Hess’ recent stock price appreciation?

While Elliott will have you believe otherwise, much of the increase in Hess’ stock price occurred following the announcement of its transformation and prior to the date Elliott made itself known to Hess and its shareholders. The many successful divestitures Hess has executed were initiated long before Elliott pursued its stealth accumulation at Hess. Elliott may try to take credit for all of the positive developments at Hess, but the facts don’t support their case. In fact, if Elliott had its way, Hess would be pursuing a flawed breakup scheme that the vast majority of knowledgeable observers believe would destroy value.

What about Elliott’s arguments that its directors would provide better oversight of the execution of Hess’ strategy?

Elliott, possibly realizing that their plan has not gained any traction, is now trying to argue that their captive nominees would help ensure better execution of Hess’ plan. If Hess shareholders want great execution, the Elliott directors are the wrong choice.

- Elliott’s nominees are being directly compensated by Elliott to pursue a short term agenda. By accepting this payment scheme, these directors have a paymaster that has substantial sway over their behavior. Directors that are structurally motivated to advance a strategy that is in conflict with Hess’ strategy are likely to undermine execution, not advance it. ALL of Elliott’s nominees have agreed to this scheme; NONE are suited to serve on the Hess Board.

- Elliott’s nominees were not able to determine that Elliott’s breakup plan was flawed. Research analysts and nearly all of the shareholders that Hess has spoken with have concluded that Elliott’s plan is fundamentally flawed. How come Elliott’s nominees couldn’t also make this determination – or is the pay scheme clouding their judgment?

- Hess’ slate comprises some of the best business executives in the world with the right experience and expertise for Hess. The entire Hess slate is new and independent; they agreed to work on behalf of all Hess shareholders after evaluating both Hess’ plan and Elliott’s plan. Notwithstanding Elliott’s false claims to the contrary, the Hess slate includes proven senior executives with leading oil & gas expertise, all of whom are new to Hess. The Hess slate includes the previous Vice Chairman of GE and CEO of GE Energy; the former top U.S. E&P executive at ConocoPhillips who pioneered expansion in emerging shale plays; the CFO of Viacom/CBS who during his tenure oversaw the transformation of a legacy industrial conglomerate into a leading media company; a recently retired member of the Executive Committee of Royal Dutch Shell, who is widely acknowledged to be one of the world’s top oil & gas executives; and the senior executive at BP who was responsible for their most important and valuable businesses. As a research analyst recently observed:

|

All-Star Board. HES will add six new independent directors, all former business executives, each with decades of distinguished careers, including three with extensive oil industry experience. The new board should help guide HES with executing its transformation strategy into a pure E&P play. |

|||||||||||

| -Fadel Gheit, Oppenheimer, March 5, 2013 | |||||||||||

| Independent Wall Street research analysts have concluded that Hess has the superior plan: | |||||||||||

|

With the steps taken over the past three years management has revealed a sound strategy that we believe is tough to beat... Hess is executing a strategy we believe underpins a material release of value. |

|||||||||||

| -Doug Leggate, Bank of America Merrill Lynch, April 25, 2013 | |||||||||||

|

With $3.4 Bn in announced proceeds, execution has been outstanding thus far. |

|||||||||||

| -Asit Sen, Cowen, April 5, 2013 | |||||||||||

|

HES presented a robust, multi-pronged strategy to accelerate its pure-play E&P transformation... We view the company's proactive stance and exceptional clarity with its investor base as a major blow to activist claims. |

|||||||||||

| -Eliot Javanmardi, Capital One, March 6, 2013 | |||||||||||

|

We take management’s side in terms of the future course of the company.... we do not think breaking up the company into an onshore resource player (Hess Resources) and international, mostly offshore, entity (Hess Remainco) is the best way to generate value. |

|||||||||||

| -Jeb Armstrong, Credit Agricole, March 26, 2013 | |||||||||||

|

If the activist end game is an outright separation of Hess into two parts, we maintain our view that commensurate risks & challenges of two stand alone entities will blur the landscape for the investment case. |

|||||||||||

| - Doug Leggate, Bank of America Merrill Lynch, April 25, 2013 | |||||||||||

|

In short…we do not believe that [Elliott’s] plan provides the best path forward. In our view, Hess's own plan makes more sense… |

|||||||||||

| -Philip H. Weiss, Argus, March 27, 2013 | |||||||||||

We believe the choice is clear. The Hess plan has momentum; it is delivering operationally and financially, while increasing shareholder returns. We urge Hess shareholders to vote for its new, highly qualified, independent director nominees to ensure that Hess’ future is guided by an independent Board of Directors focused on value creation for all Hess shareholders.

Whether or not you plan to attend the Annual Meeting, you have the opportunity to protect your investment by promptly voting the WHITE proxy card. We urge you to vote today by telephone, by Internet, or by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided. We urge you to reject Elliott’s short term, value destructive ideas by discarding any proxy materials sent to you by Elliott Management or its representatives.

On behalf of the Board of Directors, we thank you for your continued support, and we look forward to continuing to deliver outstanding value to you in the future.

Sincerely,

John Hess

Chairman and CEO

For information about Hess’ transformation and the 2013 Annual Meeting, please visit: www.transforminghess.com.

About Hess’ New, World-Class Independent Directors:

-

John Krenicki Jr. Former

Vice Chairman of GE; President and Chief Executive Officer of GE Energy

Mr. Krenicki’s experience leading large scale initiatives and operations across a global energy portfolio will add important perspective to the Hess Board as the Company completes its transformation to a pure play E&P company.

-

Dr. Kevin Meyers Former

Senior Vice President of E&P for the Americas, ConocoPhillips

Dr. Meyers was at the forefront of the oil & gas industry’s focus on developing U.S. shale formations. He led ConocoPhillips’ expansion in emerging shale plays, including the Eagle Ford, Permian Basin, and Bakken shale plays. Dr. Meyers will bring to the Hess Board decades of managing cost-efficient E&P operations in shale and conventional properties directly relevant to Hess’ focused E&P portfolio.

-

Fredric Reynolds Former

Executive Vice President and Chief Financial Officer, CBS Corporation

Mr. Reynolds will bring to the Hess Board his substantial experience as a CFO with a successful track record of financial oversight, leading a successful transformation, returning capital, and delivering long term returns.

-

William Schrader Former Chief

Operating Officer, TNK-BP Russia

Mr. Schrader is an outstanding E&P executive responsible for transforming BP’s best and most valued E&P assets, and will bring to the Board his experience as a disciplined E&P operator with expertise in production sharing structures, government relations, and delivering returns.

-

Dr. Mark Williams Former

Executive Committee Member, Royal Dutch Shell

Dr. Williams worked for over 30 years at Shell, including more than 17 years of U.S. E&P experience, serving most recently as a member of the Executive Committee of Royal Dutch Shell, where he was one of the top three operating executives collectively responsible for all strategic, capital, and operational matters. He is widely acknowledged to be one of the world’s top oil & gas executives, and will add invaluable insight to Hess’ Board.

Cautionary Statements

This document contains projections and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These projections and statements reflect the Company’s current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain risk factors. A discussion of these risk factors is included in the Company’s periodic reports filed with the Securities and Exchange Commission.

This document contains quotes and excerpts from certain previously published material. Consent of the author and publication has not been obtained to use the material as proxy soliciting material.

Important Additional Information

Hess Corporation, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from Hess shareholders in connection with the matters to be considered at Hess’ 2013 Annual Meeting. Hess has filed a definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission in connection with the 2013 Annual Meeting. HESS SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the proxy statement and other materials filed with the SEC. Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by Hess with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at Hess’ website at www.hess.com, by writing to Hess Corporation at 1185 Avenue of the Americas, New York, NY 10036, by calling Hess’ proxy solicitor, MacKenzie Partners, toll-free at (800) 322-2885 or by email at hess@mackenziepartners.com.